Since the first rate hike in Dec 2015, the Fed has been in the course of normalizing interest rates. Although we as well as many of the famed hedge fund managers expect the central bank will eventually cease raising rates and resume easing, it is still reasonable to assume one or two rate hikes in 2016 are still possible.

Even if it happens, rate cuts will follow it anyway, but it is important for investors to consider how to trade on the temporary monetary tightening. As federal funds rates futures expect only one rate hike in 2016, two rate hikes will be a surprise if it happens.

Gold is obviously one of the assets that could face a temporary correction and provide buying opportunities if the Fed forces rate hikes. We successfully bought gold in January, before it spiked.

However, there is another asset class we should consider: US REITs. Resuming monetary easing will lower long-term interest rates and then mortgage rates, and it could fuel the property markets.

US REITs

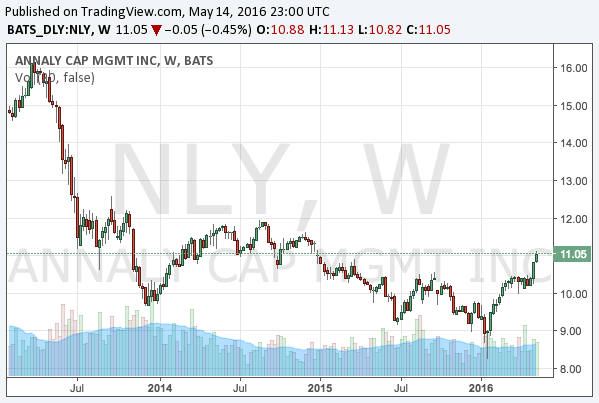

Let us first see an example of a REIT and how it has been trading in the stock markets. There is an US REIT a famous bond trader Bill Gross recommended in the interview with Barron’s (PDF): Annaly Capital Management (NYSE:NLY; Google Finance).

This is a type of a REIT that mainly invests in MBSs (mortgage-backed securities) rather than properties themselves. At the current price, the yield is more than 10%, which is fairly attractive when government bonds do not yield anything all over the world.

The moves of the stock price are similar to the gold price in the sense that it experienced a bottom in Jan 2016. Both of the prices are reacting to the number of the Fed’s rate hikes expected by investors.

Is it a buy?

Does it mean REITs are favourable if they go down as the Fed continues rate hikes? If you bet on the eventual turnaround of the Fed’s policy, there are both advantages and disadvantages of REITs compared to gold.

The obvious advantage we naturally think of is an yield. A 10% yield in the example above is quite attractive in the world of zero or negative interest rates, whereas gold, of course, has no yield at all.

Another advantage is leverage. Some REITs adopt quite high leverage, which would harm their business when the central bank raises rates, paying more for borrowing, although on the other hand they tend to perform better than others when low interest rates continue. This was also what Mr Gross pointed out in the interview.

The disadvantage is, however, that it would be affected by the slowdown of the US economy. Whilst gold’s physical demand is limited, the property market is directly subject to the demand of houses. If the strategy is to bet on the expectation that the Fed will cease rate hikes as the economy slows down, then betting on something that could be affected by the slowdown is in itself a sort of contradiction.

Conclusion

Considering these circumstances, buying REITs could be an option if they experience a correction as the Fed remains hawkish, although the writer personally prefers gold for its lack of uncertainties. As long as the scenario of the Fed eventually changing its mind is right, there are almost no negative factors for gold to be a boom.

Nevertheless, it is always good to have more choices, although what we do now is just to wait for the Fed’s next move, just keeping the gold position we made in January.