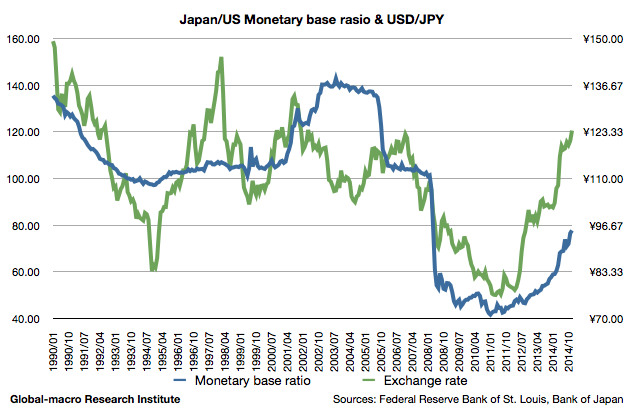

As the BoJ only claimed it would continue its quantitative easing until mid 2016, investors are now speculating whether the central bank extends the easing or not.

In this article, we discuss the impact of the QE extension/expansion to USD/JPY to clarify if the BoJ has an effective means to affect the currency market to support the inflation. We first review the chart of the monetary base ratio:

Continue reading 2015-2016: What will happen to USD/JPY when the BoJ expands the QE further?

Continue reading 2015-2016: What will happen to USD/JPY when the BoJ expands the QE further?