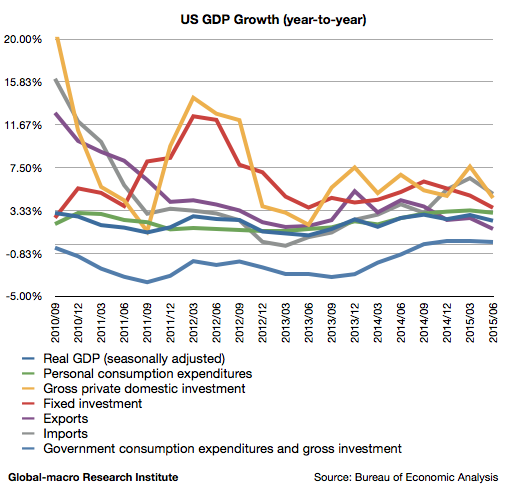

The commodity markets are tumbling. Gold, oils and almost all the other commodities are immensely depreciated. It may be seemingly explained by the Fed’s rate hike and the slowdown of the Chinese economy, but the two following factors can’t be explained by them:

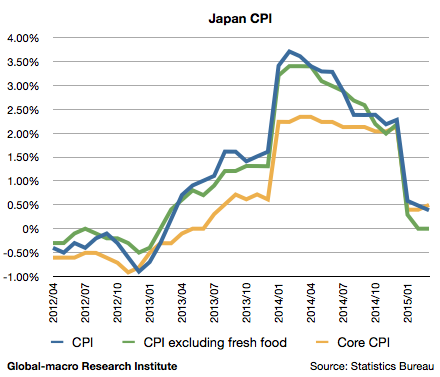

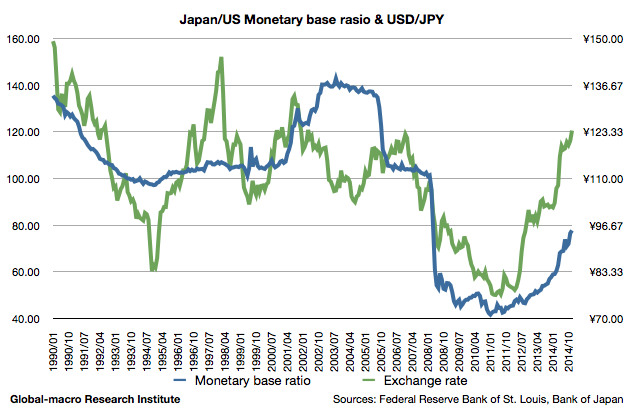

- The prices are radically falling even in the currencies with the quantitative easing, such as the yen and the euro.

- The prices have fallen to the range before the US started the QE after the financial crisis in 2008.

Although the Fed has surely stopped the QE, they haven neither sold the purchased bonds nor raised the interest rate. If, in addition, the Bank of Japan and European Central Bank stopped the QE, the commodity prices could tumble further, so that what has happened after the massive QE is the deflation. It would be very unreasonable, and so investors need to conceive a reasonable explanation for it.

Continue reading The commodity market crash leads to worldwide deflation: gold, crude oil, natural gas, copper and iron ore →