We continue to research how the financial markets moved amid the subprime-loan crisis in 2008. In the previous article, we illustrated that the fall of the US house prices had actually warned investors several months before the stock markets collapsed.

Many asset classes suffered from the crisis. In such a situation, bonds and commodities are sometimes the keys to benefit from the adversity.

Gold and Treasury bonds

Investors would think of gold and government bonds as a “safe haven” during a financial crisis. Also in 2008, it was proven that buying gold and US Treasury bonds amid the crisis was a right investment idea for a long term, but these two assets moved quite differently in a short term.

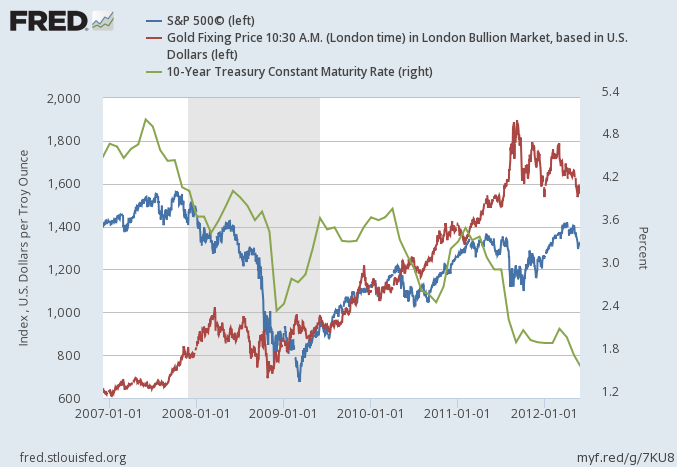

The following is the chart of S&P 500, the gold price and the 10-year US Treasury note yield around 2008:

The three graphs apparently went down in 2008, but we need to note that it is the yield, not the price, of 10-year Treasury bonds.

The decrease in the bond yield means the increase in the bond price. The chart shows, therefore, that whilst the stock market and the gold price fell in 2008, the Treasury bonds surged.

The factors that determine bond prices

Then, what boosted the bond prices? Fundamentally, there are three factors that drive bond prices:

- Expected inflation rate

- Expected real economic growth

- Risk premium

First, buying bonds is to lend money to somebody. So if you lend $1,000 and receive the same amount of money after some time under inflation of 10%, you are effectively losing the 10%.

If the inflation rate is too high, you would prefer buying things to lending money, so this is how inflation affects interest rates.

Second, from a view point of borrowers, companies would choose to borrow money limitlessly as long as the interest rate is lower than the expected gain from the business they could do with borrowing. So real interest rates should be, in a long term, the same as the real economic growth.

Lastly, interest rates are naturally affected by credibility of a borrower; if you lend money to almost-bankrupt companies, you would require high yields. The increase in the rate due to borrower’s credibility is called risk premium.

As the risk premium for advanced economy’s government bonds is normally considered to be near zero, the calculation of long-term interest rates is theoretically the following:

- Long-term interest rate = Expected inflation rate + Expected economic growth

What exactly happened in 2008

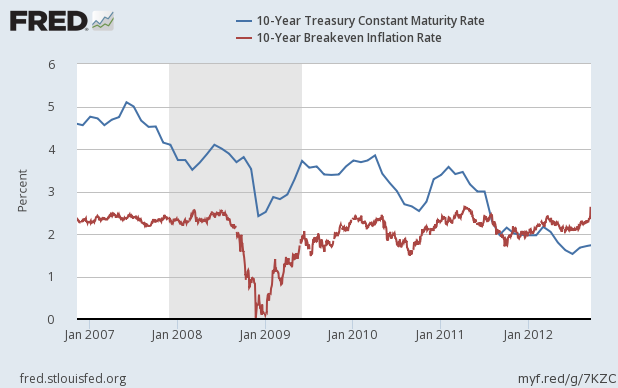

Now we know why the Treasury bonds surged in 2008. The following is the chart of the 10-year Treasury bond yield and the breakeven inflation rate:

The interest rates went down as the breakeven inflation rate fell. The relation is obvious when you see the formula above. This is what exactly drove the bond prices.

The gold price fell due to the same cause

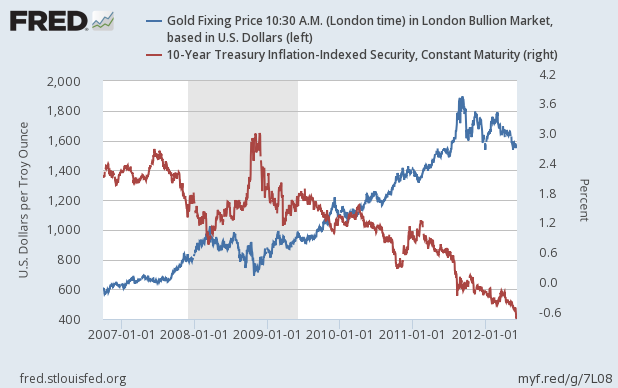

On the other hand, the gold price fell due to the decrease in the expected inflation rate. Since inflation means prices of things go up, the decrease in expected inflation meant the plunge of the gold price.

The gold price is known to move against real interest rates. Real interest rates are the index that rises with high nominal interest rates and also with low inflation. This is the index that is the opposite of the gold price.

As you can see in the chart, in 2008 real interest rates went up due to low expected inflation, and thus the gold price plunged.

Conclusion

However, as we know, gold eventually became a huge bubble, rising up to $1,800 in 2011, as a result of the eventual rate cuts and the start of quantitative easing. Compared to the relatively rational bond markets, which consider the inflation and the economic growth, gold is strong when it becomes euphoria.

So investors should wonder very much about whether they should buy bonds or gold in such a situation. Shorting stocks, buying bonds and buying gold are all similar in some sense, but they have different details indeed.