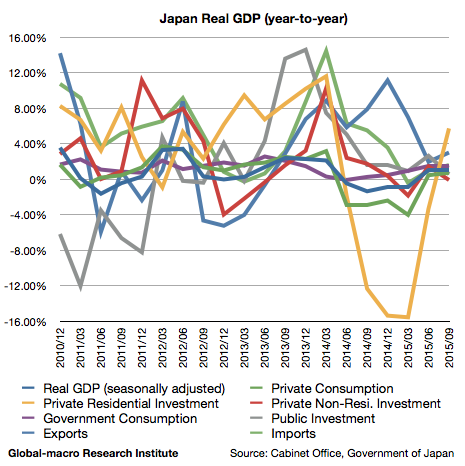

Donald Trump won the presidential election in 2016. Then the next question is: what does it mean to the financial markets? As Mr Trump plans to increase the federal debt to invest in infrastructure, the markets now expect high interest rates worldwide, but if you look at President Trump’s policies more carefully, you might assume something different could take place: rate cuts and QE.

Continue reading President Trump could cut rates and restart QE to fight against secular stagnation