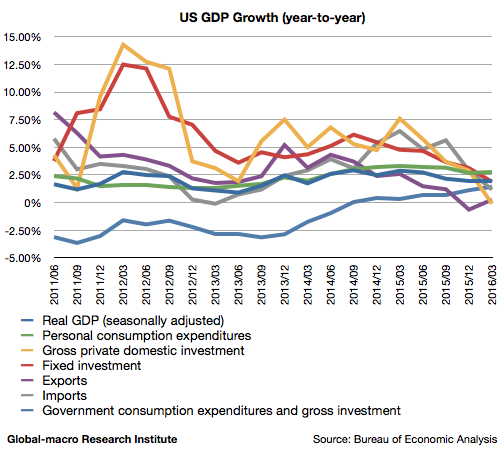

The GDP data of the US economy for the first quarter of 2016 is published, and the real GDP growth turned out to be 1.95% (year-on-year), slightly slowing down from 1.98% in the previous quarter.

As the economic growth in mid 2015 was greater than 2%, the figure indicates the economy has decelerated after the Fed ceased quantitative easing.

Continue reading 2016 1Q US GDP: the slowdown continues, justifying the weak dollar