The eurozone’s economy is at the edge of collapse. Southern European countries experienced a sovereign debt crisis in 2010, and the unemployment rate in the euro area is still as high as nearly 10%. Italy rejected Mr Renzi’s pro-EU reform plan in the referendum, and in France, the anti-EU National Front’s Ms Le Pen is increasingly popular.

Yet what is the cause? Whilst the EU also faces the immigration crisis, the economic reason will be easily comprehended by only glancing at the trade statistics of the eurozone countries.

Continue reading The eurozone is a German colony, the net exports of the member states explain →

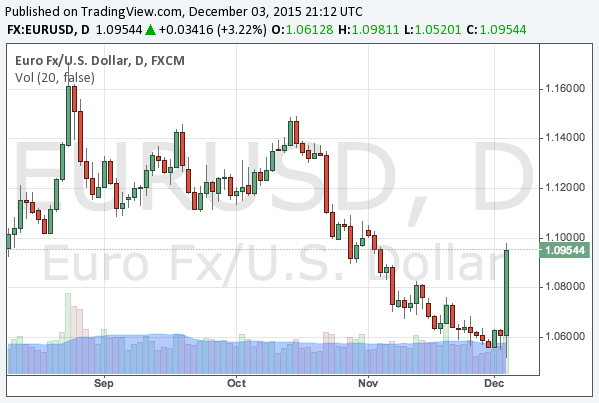

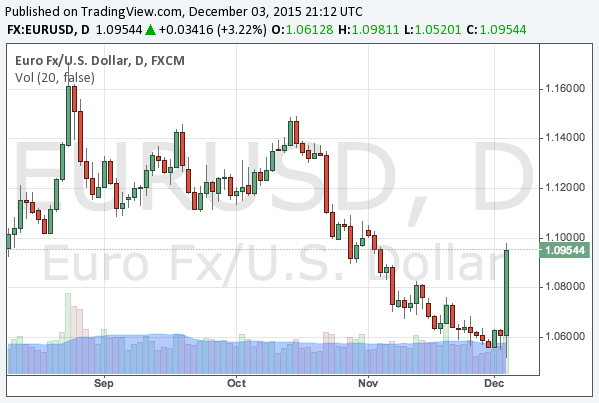

On the 3rd of December, the ECB (European Central Bank) decided to cut interest rates and extend its quantitative easing. The deposit rate was lowered from -0.20% to -0.30%, and it was declared that the central bank would maintain the QE until March of 2017, postponed from September of 2016.

As Dr Mario Dragi, the governor of the ECB, had suggested further easing in advance, some investors were expecting the expansion of the QE, which was not decided this time. Consequently, EUR/USD sharply rebounded.

Continue reading ECB cuts rates and extends the QE, the negative market reaction suggests the end of the QE bubble →

Continue reading ECB cuts rates and extends the QE, the negative market reaction suggests the end of the QE bubble →

As we have written, there is no large economy in the world that is growing rapidly. Reflecting the decreasing demands in the world, including the Chinese economy slowdown, the commodity markets completely collapsed, such as copper and iron ore.

However, it does not mean any single small country does not enjoy any significant growth. Thus, we review the world’s economy again to find out which area is the most profitable for investors to bet on.

Continue reading World’s GDP & stock market comparison: southern Europe finally starts to recover, Japan sinks →

After much ado, Greece reached an agreement with the Troika of creditors, and investors seem to be convinced that the crisis is over, as the yield of 10-year Greek government bond, which was largely sold before the agreement, went down to 8% from 19%.

Is the Greek debt crisis really over? Is the Greek economy going to recover? Unfortunately, you would know it will not as long as it is in the euro zone, if you are familiar with economics. Germans do not want to admit it. Greeks do not want to believe it.

Continue reading The fatal flaw of the euro zone: how Germany is increasing the Greek debt →

The ECB (European Central Bank) is expected to have a Governing Council meeting at 1:45pm CET, which has been keenly watched by investors since Mario Draghi, the governor of the ECB, mentioned the possibility of financial easing in this meeting. Continue reading Reviewing the euro, the German government bond and property companies →

Analysis and Practice in the Global Markets