The currency war, the market turmoil and the secular stagnation will make the gold price skyrocket to $2,000 in 2017 or 2018.

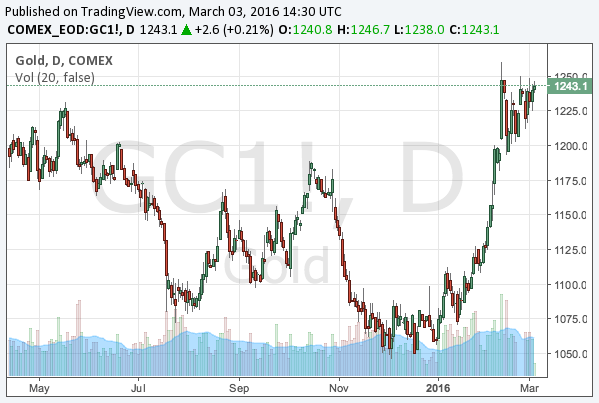

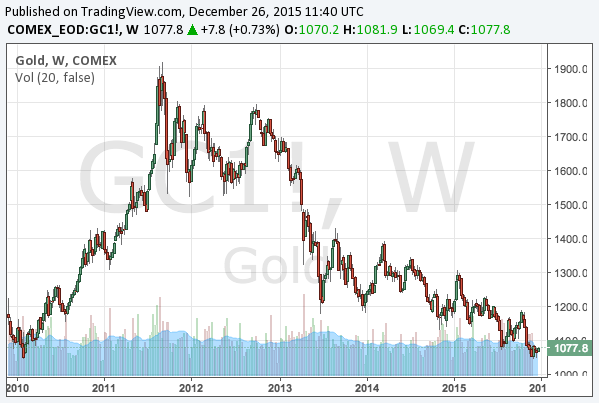

In Jan, 2016, we predicted the turnaround of the gold price, and since then gold has indeed rebounded from its three-year bear market as you see in the following chart of the gold price:

The timing of our prediction was perfect. Investors finally realized three or four rate hikes in 2016 are practically impossible, and the secular stagnation will keep the US and global economy in need of financial easing. In addition to it, there are several facts for which we can be bullish about gold.