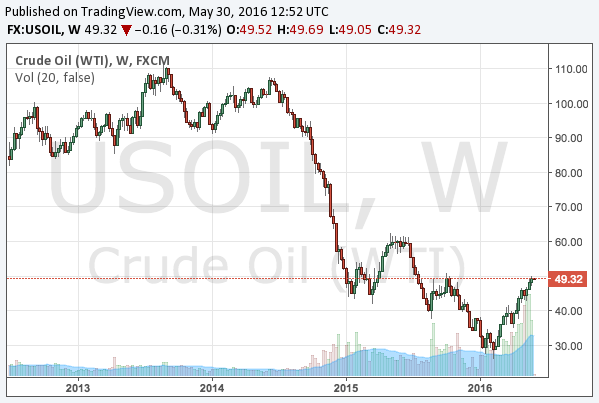

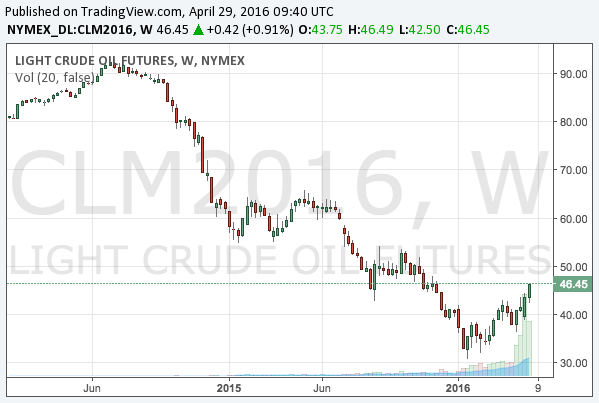

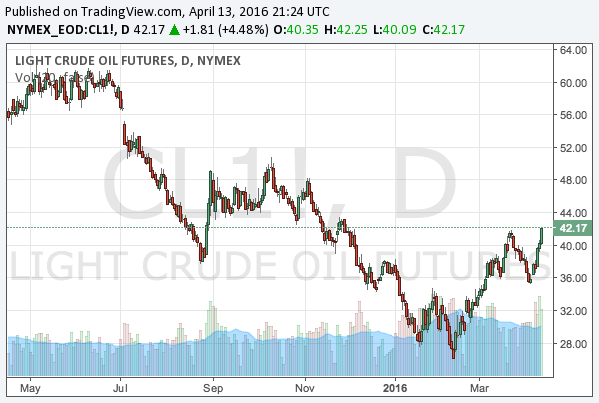

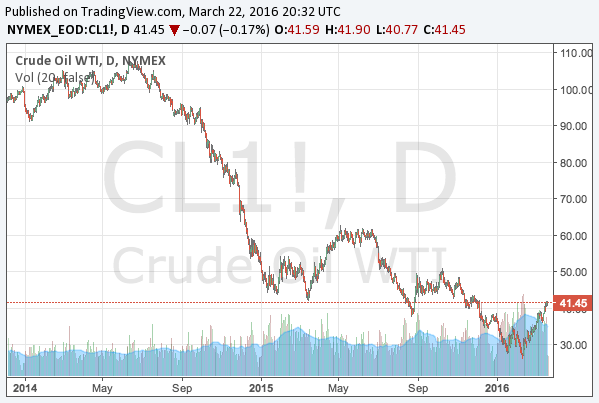

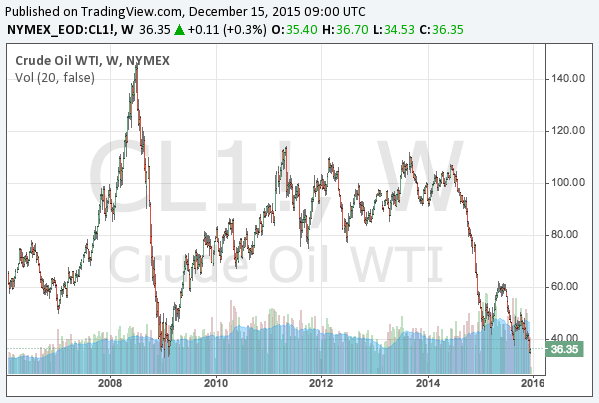

After the radical crash in 2015, the WTI crude oil price has been trading around $30s, and many try to forecast how long it will remain low.

The prospect of the crude oil price depends on the two factors: the OPEC and the US shale oil industry. Whilst the OPEC now tries to cooperate to freeze production, Saudi Arabia is still unwilling to cut its output.

Then what about the US shale industry, which Saudi Arabia tries very hard to kill? They surely have larger costs for production, and then it would be them that would die out if low oil prices continue.

The shale oil companies published their earnings releases in February, and this article is examining the results. Are they cutting production? Are they close to bankruptcy? These factors will be necessary to know in order to foresee the future of oil prices.

Continue reading Shale oil companies’ earnings releases predict the crude oil price in 2016 →