We continue to research how the financial markets moved amid the subprime-loan crisis in 2008. In the previous article, we illustrated that the fall of the US house prices had actually warned investors several months before the stock markets collapsed.

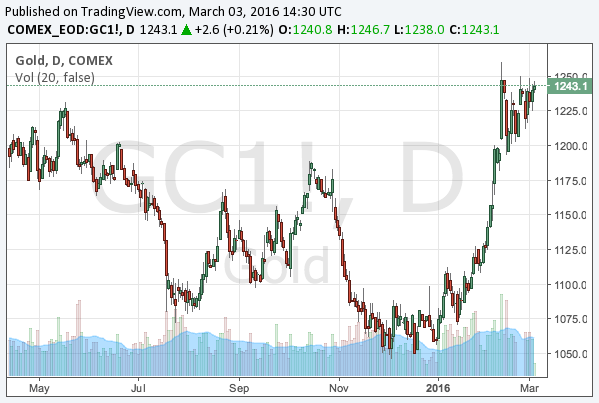

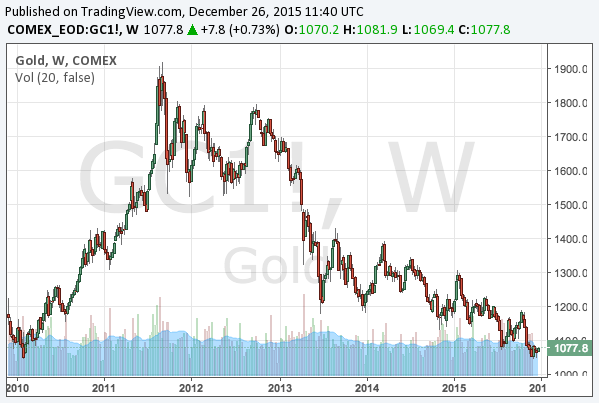

Many asset classes suffered from the crisis. In such a situation, bonds and commodities are sometimes the keys to benefit from the adversity.

Continue reading Benefiting from the financial crisis: gold and US Treasury bonds in 2008