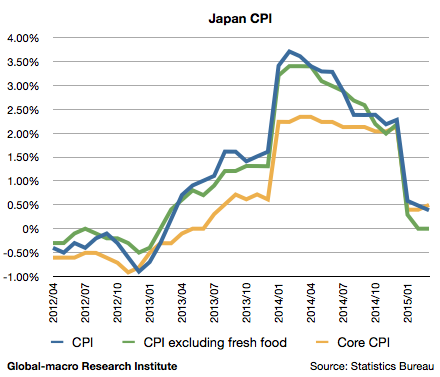

Did Abenomics successfully save Japan from deflation? Not really. Will quantitative easing and negative interest rates by the Bank of Japan (BoJ) make it better in the future? Not very likely.

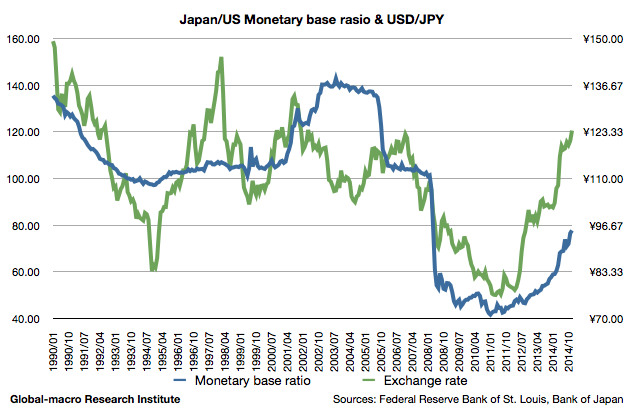

The BoJ is no longer controlling the monetary policy of the Japanese economy. The central bank has already taken all the effective options, and thus the room for expansion of easing is quite limited. There is something that decides the monetary policy instead of the central bank.

Continue reading Explaining Japan’s deflation 2016: the cause is not just the consumption tax hike