Wacom (TYO:6727), the Japanese exporter of graphics tablets introduced before, is now having the short selling of institutional investors. As of 30 May, Goldman Sachs has a short position corresponding to 4.04% of all the issued stocks, and Deutsche Bank has that of 1.31%, the total of which is 5.35%. Interestingly, after their short selling, Credit Suisse cut its price target from ¥800 to ¥460, with the stock price falling by 4.6% on the day, giving the rational investors a good opportunity to buy more. Continue reading How to short squeeze Goldman: How Wacom (TYO:6727) will overcome the short selling

Monthly Archives: May 2014

The EU election results will lead the euro zone to a genuine growth

In the EU elections from 22nd to 25th, the anti-EU parties, like Front National in France, enjoyed their victory as the European citizens couldn’t stand with the fiscal austerity that had been imposed to them. Recognising the results, the German prime minister Angela Merkel mentioned the necessity of accepting the needs for more dovish fiscal policies. This is the first step of the true economic growth of the euro zone, which the market has been longing for. Continue reading The EU election results will lead the euro zone to a genuine growth

Followup: Gecina, CNNC International, Heiwa Real Estate

The following is the reviews of the stocks introduced before:

It has gone up averagely, although it’s still traded at an affordable price. If you bet on the ECB’s financial easing, this will be a better option than selling the euro. We need to note that if the ECB isn’t to start the QE next month, a good opportunity to buy this stock will come again between the next meeting of the ECB and the QE. Continue reading Followup: Gecina, CNNC International, Heiwa Real Estate

In a short term, the euro is dumped too much

Since Mario Draghi, the governor of the ECB, mentioned the possibility of financial easing next month, EUR/USD has been dropped from 1.40 to now around 1.36, although it could be too much to fall. Continue reading In a short term, the euro is dumped too much

OECD says Germany is now the second most popular among immigrants

According to OECD, the immigration flow to Germany reached 400,000 in 2012, making Germany the second most popular destination for immigrants, following the US. Germany was the eighth popular in 2009. Urged by the euro zone crisis, the 300,000 immigrants were from other EU countries, since many jobless people sought a job in Germany, the economy of which had been recovering the most successfully in the euro zone.

The unemployment rate Italy remains 12%, and that of Spain remains 25%. The flow of the jobless people is supposed to oppress the German labour market, lowering the PPI.

As has often been pointed out, the fatal flaw of the euro is that any of the countries isn’t allowed to adopt the monetary policy that suits the economic situation of the country. Since Germany hates inflation, the ECB can’t do what they must do. In the meeting next month, some financial easing is expected, although a mere interest rate cut could hardly stop the structural disinflation.

[Stock] Wacom (TYO:6727): A Japanese exporter depreciated to the level before Abenomics

Wacom Co., Ltd (TYO:6727)

Google Finance – Wacom Co., Ltd: TYO:6727 quotes & news

In the Japanese stock market, Japanese exporters have been depreciated due to the strengthened yen, but some of them are dumped too much. Especially Wacom, the graphics tablet maker that holds the 80% of the market share in their market, has been dumped to the price at which the stock was traded before Abenomics. Since then, however, the yen has been depreciated by 20%, and the company’s revenue has grown by 30%. This article explains why it’s a great buying opportunity, by mentioning the brilliant growth of the market of tablet computers, which affects the company’s revenue very much. Continue reading [Stock] Wacom (TYO:6727): A Japanese exporter depreciated to the level before Abenomics

How much can the euro fall down if ECB starts the QE?

After Mario Draghi, the governor of European Central Bank (ECB), mentioned the possibility of financial easing started in the next meeting of the central bank, the speculation occurred also in the currency market following the European real estate stocks that had been already boosted for months. (See the article on Gecina.) EUR/USD is now traded at 1.37, falling down by more than 1%.

The news currently mostly tells about the negative interest rate, not the quantitative easing, but if the other methods couldn’t hinder the inflation rate from diminishing, the ECB would have no option but the QE. Therefore, in this article we estimate the due rate of EUR/USD after the QE. Continue reading How much can the euro fall down if ECB starts the QE?

BOJ’s Kuroda mentions the inflation rate after QE

According to Reuters (the source in Japanese), BOJ’s Kuroda said the inflation rate would remain fairly strong after the central bank achieves the inflation target of 2%. This statement is significant in the sense that he implied the moderate increasing of the inflation would be acceptable even after it becomes 2%.

As the increasing of the inflation usually follows the financial easing, considering the fact that the BOJ is willing to continue the QE until the inflation rate becomes 2%, the inflation rate is likely to increase after the QE up to around 2.5%. Consequently, the long-term interest rate, which is currently around 0.6%, couldn’t avoid to be hiked after the BOJ finishes the QE. The time to be short the bond futures is approaching.

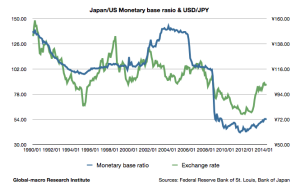

Outlook of USD/JPY by the monetary base difference

This is the graph of USD/JPY and the ratio of the two countries’ monetary bases since 1990. For a decade since 1995, the amount of the issued yen per a dollar had been around 100 with the exchange rate being around ¥115, but then the Fed moved to financial easing according to the crisis in 2008. As a result, the ratio went down to around 50, which has still been the range until now as both of the central banks have been engaged in quantitative easing.

It is assumed that the monetary base ratio will resume to be 70-75 when the Fed totally stops the easing and the Bank of Japan finishes the QE of 2 years. The last time we observed that range of the ratio was from Oct to Nov in 2008, when the exchange rate was around ¥98.

To estimate the current due exchange rate from this, we need to consider that the foreign exchange market usually precedes the monetary base, and that in late 2008, the market was in a hurry to reflect the quantitative easing that would be held afterwards. We also need to note that according to the data by the IMF, the real economic growth of the US between 2008 and 2014 is estimated to be 9.2% whereas that of Japan is assumed to be merely 2.8%. Considering these, the current range of the exchange rate, ¥100-105 can be said to be quite appropriate, and due to the Japan’s trade deficit, which hasn’t decreased even with the weak yen, would lead the rate to be ¥105-110 in a middle or long-term.

In a short term, investors should be careful of the enormous short positions on the yen, which have been piled since late 2012, although the situation wouldn’t help the speculators demoralise the market, as few factors are seen to change the investors’ long-term view, and the additional QE is still possible if the inflation rate doesn’t increase. The investors would need to move in the Japanese stock market considering this moderate future of the currency market. After a fuss, with the speculators discouraged, the cheap and expensive stocks will just come to the due price, without causing any dominant trend in the Nikkei index.

Office vacancy rate continues to improve in Japan

According to Miki Shoji, the office vacancy rate in Apr in the central Tokyo was 6.44%, improved 0.06% from Mar, 1.9% year-to-year.

In the business district in Sapporo, the vacancy rate was 8.36%, improving 0.09% from Mar and 0.82% year-on-year.

In the business district in Sendai, the vacancy rate was 11.62%, improving 0.13% from Mar and 1.64% year-on-year.

In the business district in Yokohama, the vacancy rate was 9.29%, improving 0.04% from Mar and 0.42% year-on-year.

In the business district in Nagoya, the vacancy rate was 8.95%, improving 0.08% from Mar and 1.61% year-on-year.

In the business district in Osaka, the vacancy rate was 9.45%, which was the same as in Mar and improved 1.75% year-on-year.

In the business district in Hukuoka, the vacancy rate was 9.62%, improving 0.47% from Mar and 1.97% year-on-year.

Although the rent of offices aren’t directly under the influence of the tax hike, it’s notable that one of the statistics showed the continuous recovery of the property market in Japan after the tax rise. The investors will keep their eyes on other statistics such as Apartment Market Overview (19 May), Department Stores Sales (20 May) and Building Construction Statistics (29 May).