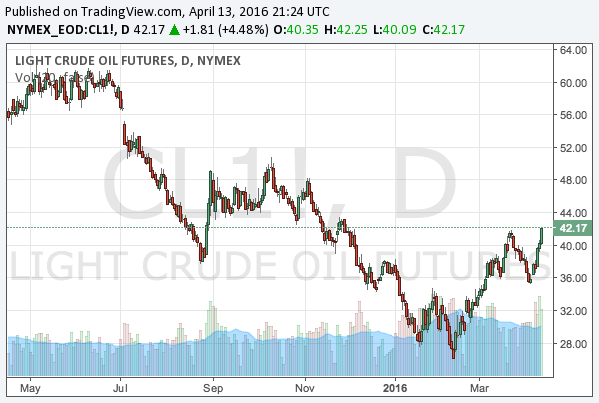

The oil price is surging as investors expect the oil producers’ meeting in Doha on 17th of April could stop the oversupply of oils, and so the WTI crude oil price is now trading in $40s. This could provide a very good opportunity for investors to short sell.

What is expected in the Doha meeting is an agreement on an output freeze. However, what is sure is that an output freeze would not alleviate the oversupply, whereas an output cut could. The oil producers are already producing sufficient oils to flood the market, and so how could we expect any improvement if they try to freeze the production at that level?

The US shale industry is also still active

The bad news for oil investors is that the US shale companies are also producing a lot of oils actively. As we reported, their cash flow is still fairly sound, and the recent surge in the oil price could even improve their situation.

If nobody in the world is cutting outputs, then obviously we could not expect any rise in the oil price.

If an output cut is discussed in the Doha meeting, we could expect a bull market. If not, however, the market’s reaction would be something typical: buy on the rumour, sell on the fact.

When to short sell

Then, at which price can we short oils? In the following article, we predicted $60 would be the top of the oil price:

Therefore, $50s is the range where we can start short selling, and $40s is where we can sell call options, which are expected to make a profit when the price does not go up. For options, please read the following article:

How high will the oil price go up on the Doha meeting? The best occasion for us is that it goes up to $50s, and an output freeze, not a cut, is decided. Let us see what will come out.