As the BoJ only claimed it would continue its quantitative easing until mid 2016, investors are now speculating whether the central bank extends the easing or not.

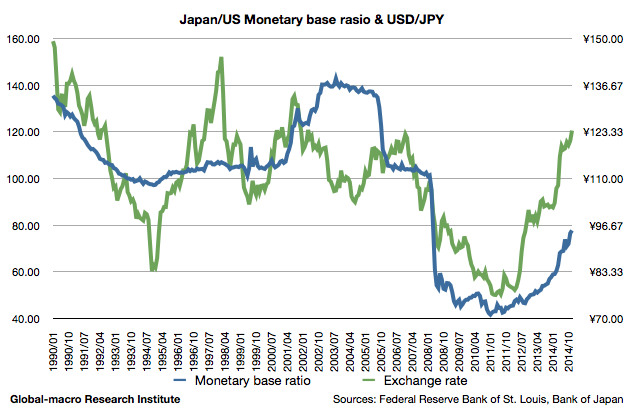

In this article, we discuss the impact of the QE extension/expansion to USD/JPY to clarify if the BoJ has an effective means to affect the currency market to support the inflation. We first review the chart of the monetary base ratio:

As of June 2015, the Japan’s monetary base is ¥313 trillion, and the BoJ is increasing it by ¥80 trillion per year. If we assume the QE continues until June 2016, therefore, the monetary base will be around ¥390 trillion.

This means that considering that the US monetary base is supposed to be kept around $4 trillion, the monetary base ratio will be roughly 100, the middle of the chart.

At the monetary base of 100, USD/JPY historically moved at around 115-120. Considering the difference of the economic growths of the US and Japan, USD/JPY would be reasonable at 120-125. If the Fed raises the interest rate, it could be 125-130.

What kind of further easing is possible?

The question is how the BoJ can exert further easing. We consider the most likely decision is to extend the current quantitative easing, increasing the monetary base by ¥80 trillion per year.

However, the extension would no longer affect the monetary base ratio significantly. If the QE is extended until June 2017, adding another ¥80 trillion, it’d only increase the monetary base by 20%.

This would move the monetary base ratio from 100 to 120, at which USD/JPY was historically at around 125-130. Considering the economic growth difference, USD/JPY would be 130-135. With the expected rate hike, it’d be 135-140.

The QE’s influence on USD/JPY is getting weak

As the monetary base becomes more massive, the QE becomes less effective on the exchange rate. The BoJ governer Kuroda said he wouldn’t expect the weaker yen, and that was perhaps his honest view.

From here, it’d have to be rather qualitative than quantitative, and therefore the BoJ might consider to expand its purchase of REITs and ETFs, which would fuel the financial markets further.

Regarding the timing of extension/expansion, we will publish another article.