The currency war, the market turmoil and the secular stagnation will make the gold price skyrocket to $2,000 in 2017 or 2018.

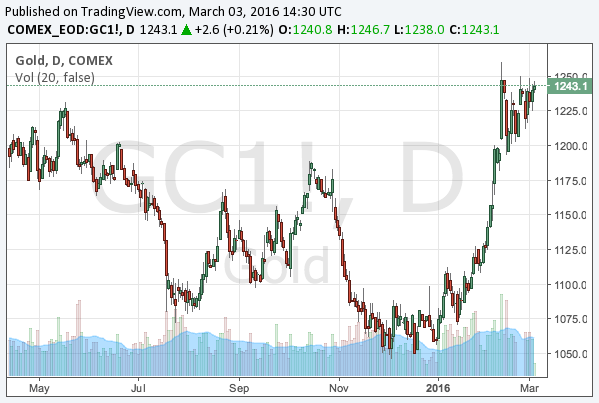

In Jan, 2016, we predicted the turnaround of the gold price, and since then gold has indeed rebounded from its three-year bear market as you see in the following chart of the gold price:

The timing of our prediction was perfect. Investors finally realized three or four rate hikes in 2016 are practically impossible, and the secular stagnation will keep the US and global economy in need of financial easing. In addition to it, there are several facts for which we can be bullish about gold.

Low interest rates worldwide

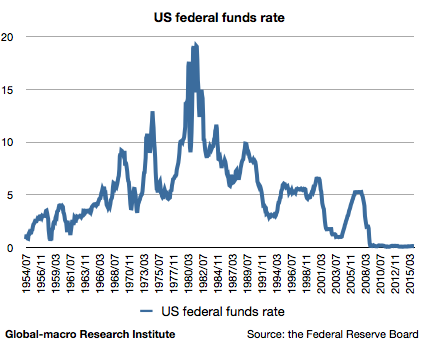

The primary cause of the future gold boom is, of course, the correlation between the gold price and the Treasury bond price. People want to buy the dollar when interest rates are high, and with low interest rates gold becomes relatively more attractive as a haven.

The above is the long-term chart of federal funds rates, which has an obvious downtrend for decades due to the low economic growths in the advanced economies. Economists such as Larry Summers suggest the possibility of the secular stagnation, which will keep the economic growth and the inflation low or negative for a long time.

The symptom of the secular stagnation is already seen in the US. The GDP data for the last quarter of 2015 revealed the growth is decelerating.

The central banks will be then eager to devalue their currency. The currency war will boost the needs for gold as a haven. We are repeating what happened after the subprime loan crisis in 2008, when gold was set to climb up to $1,900. The following is the long-term chart of the gold price.

Very few investment opportunities worldwide

The situation is actually not just as good as in 2008 but much better for gold in 2016. In 2008, the Fed started the quantitative easing. The dollar was depreciated, but investors could also buy stocks or properties to avoid the devaluation of the assets in dollar.

However, in 2016, the QE has already boosted the asset bubble, and there would not be much room for further appreciation. The situation is already how slowly it could collapse, not how high it could go further.

With much less havens they can hide in, the value of gold will be appreciated even more than it had been since 2008.

Not affected by the weak demand worldwide

Thus, you can neither buy currencies, stocks nor properties. Yet then, how about other commodities? Is it not more productive to buy something more useful than just a yellow kind of metal? Oils, gas, copper or iron ore? Unfortunately, usefulness is not necessarily appreciated in the markets of 2016.

The secular stagnation is a situation where the weak demand is the cause of everything. The low inflation and growths all depend on it. As a result, the useful commodities would be depreciated as they are less needed. This already happened in 2015.

On the other hand, gold is a rare kind of commodities which depends on the non-physical demand. Apart from the needs in the jewelry or dental industry, gold is bought by central banks or other financial institutions for their reserves, which means gold is much less affected by the weak demand in the economies than the more useful commodities.

Conclusion

We are bullish on gold for the following reasons:

- The secular stagnation devalues currencies and leads to low interest rates worldwide

- Investors cannot buy stocks or properties to avoid the risks of the currency devaluation

- Gold is much less affected by the weak economic demand than other assets

Only the first reason existed in 2008, and it led gold to $1,900. Then what should we expect in 2016?

Buy gold, hedge short-term risks of corrections, and then we believe you will be very much rewarded in 2017 or 2018, when the Fed admits it needs to restart the QE. 2016 will be a good year for good investors.