Did Abenomics successfully save Japan from deflation? Not really. Will quantitative easing and negative interest rates by the Bank of Japan (BoJ) make it better in the future? Not very likely.

The BoJ is no longer controlling the monetary policy of the Japanese economy. The central bank has already taken all the effective options, and thus the room for expansion of easing is quite limited. There is something that decides the monetary policy instead of the central bank.

The CPI matters again

What is then determining the monetary policy? That is the CPI (Consumer Price Index). Effectiveness of monetary easing does not count on nominal interest rates but real interest rates, and real interest rates are, according to Fisher equation, nominal interest rates minus inflation.

The Bank of Japan already expanded QE and introduced negative interest rates. When nominal interest rates have no huge room for downside, the inflation rate decides real interest rates, which means inflation decides easing.

We should recall that George Soros said in Davos in January that the key issue is deflation. That is because deflation comes with low demand and low growth and increases real interest rates, which means monetary tightening.

Inflation decides the monetary policy

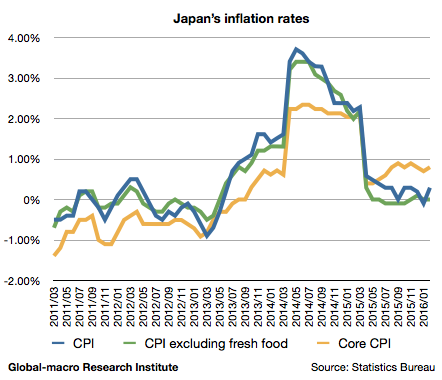

Accordingly, it is no longer the central banks that decide the monetary policy, but it is the inflation rate that decides real interest rates. Then, what is the CPI in Japan at the moment? The following is the graph:

The figures are year-on-year, and thus the temporary bump since April 2014 for one year is due to the consumption tax hike. Disregarding that influence, which is about 1.7% to temporarily elevate the figures, the Core CPI seemed to accelerate in late 2013, peaked in late 2014 and recovered again in late 2015.

We may say the slowdown in late 2014 is a result of the tax hike, but there is another factor that explains the mentioned trend in the CPI. That is the yen.

The yen depreciation and the CPI

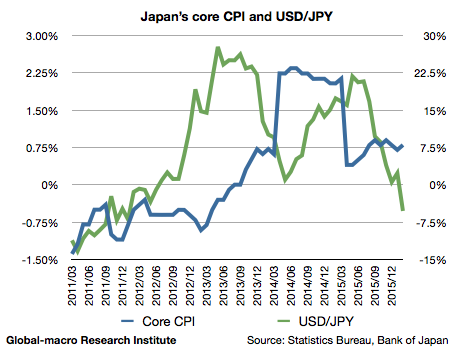

So we prepared a chart of year-on-year USD/JPY and the Core CPI, which would make it easier for us to review the influence of the currency on inflation.

The chart shows us that the trend of the CPI is following USD/JPY by the delay of half an year. When Abenomics started, the USD/JPY went up first, and then the CPI started to accelerate. The currency pair had decelerated since late 2013 until early 2014, and the CPI slowed down in late 2014. USD/JPY climbed up again in early 2015, and in late 2015 the CPI firmed.

Now in 2016 we observe the USD/JPY tumbling. Then what will happen to the inflation rate?

How the currency influences the CPI

The following is the list of the ways in which Abenomics tries to elevate inflation:

- The yen depreciation lifts import prices.

- Asset prices go up.

- The decrease in the unemployment rate allows consumers to purchase more items.

- Low interest rates promote consumers’ borrowing to consume.

Out of these elements, the two on the top are mutually related because Nikkei 225 follows USD/JPY as the Japanese exporters rely on the exchange rate. On the third factor, Japan already achieved full employment. On the last, nominal interest rates have a limited downside as the BoJ has no effective way to ease further.

Therefore, we conclude the inflation rate now largely depends on the currency, and the outlook for USD/JPY in 2016 is not very hopeful as we explained.

Then we now know what would happen to the CPI in the future, and if the CPI sinks, it means the monetary tightening for the already sinking Japanese economy.

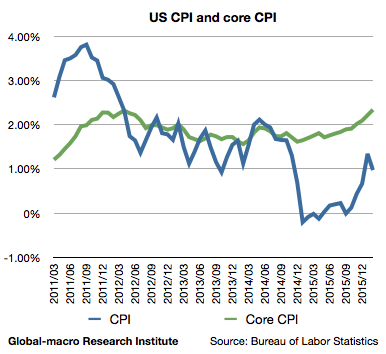

The inflation in the US is also interesting. The CPI itself is still near zero, but the Core CPI is surprisingly already over the Fed’s 2% inflation target.

This could affect the Fed’s decision on rate hikes, and that would be important for gold investors. We will also look into this within the following days.