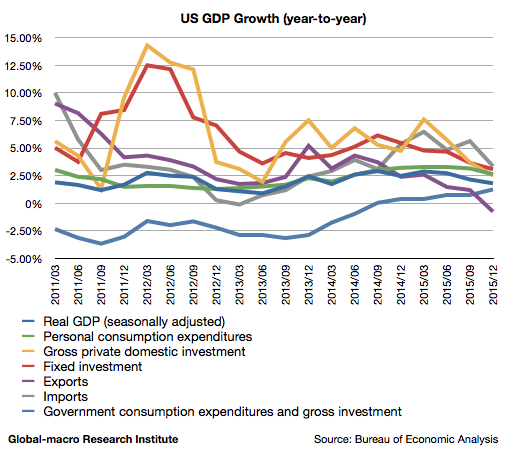

In 2016, the Fed is trying to raise interest rates. The US economy is actually starting to decelerate, but the Core CPI (excluding food and enegies) is edging higher. If this uptrend is long-term, the Fed might be forced to rush for rate hikes undesirably.

Will that happen? Is the US economy going into stagnation? In this article we argue the outlook of inflation in the US and its influence on rate hikes, the stock markets and the gold price.

Continue reading The US inflation forecast 2016: the graph edges higher, implying stagflation