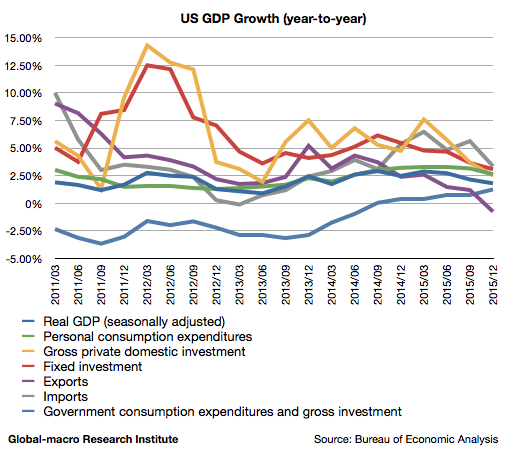

The US economy only grew 1.80% (year-on-year) in the 4th quarter of 2015, slowing down from 2.15% in the 3rd quarter, according to the real GDP data. Regarding its elements, the personal consumption, the fixed investment, the exports and the imports decelerated respectively.

As you see in the chart, the worst element is the exports. It is also notable that the personal consumption did not accelerate despite the radical decline in energy prices.