The investors are trying to be prepared for the Fed’s raising the interest rate in late 2015 and 2016, worried about how much it could affect the markets, but they seem to have forgotten what has been supported the markets for several years.

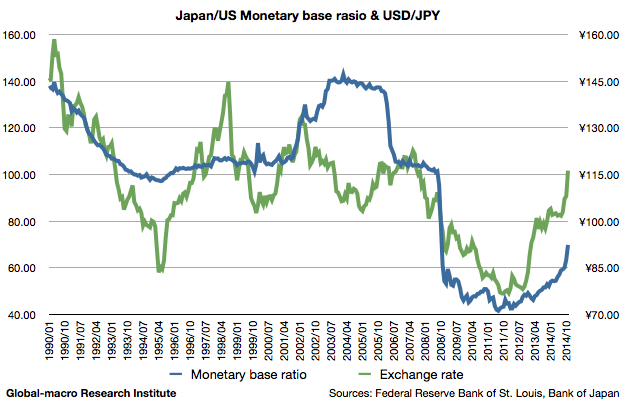

Have we already overcome the termination of the Feds’ QE? The answer is no. Although the interest rates are kept relatively low, and the US stocks remain near the all-time high, the markets are just supported by QEs by Bank of Japan and European Central Bank.

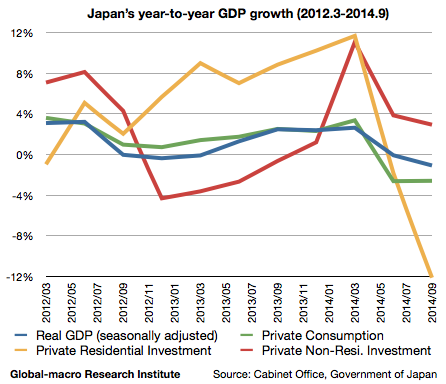

The portfolios of the investors of all kinds have been distorted by the QEs. According to the paper by the Fed, due to the QE the owners of Treasury securities and MBS shifted their funds into riskier assets. For example, the households sold Treasury bonds and MBS to the Fed and bought riskier assets such as corporate bonds, commercial paper and municipal debt and bonds.

Continue reading Fed rate hikes will reverse portfolio rebalancing and end QE bubbles