After writing about the US economy and the oil price forecast, this is finally about the main issue: gold. The gold will be a boom in 2017, but the question is when to buy gold in 2016.

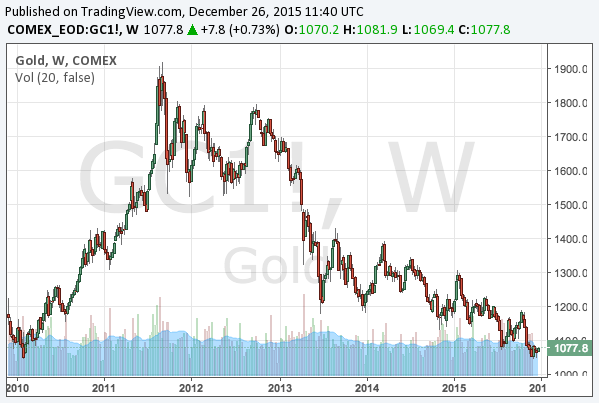

After the mortgage loan crisis in 2008, as the Fed started quantitative easing, the gold price once reached $1,900 in 2011. However, as the Fed stopped the QE in 2014 and started raising interest rates in 2015, the gold price has been radically falling.

Continue reading 2016 Gold price forecast: gold will be a boom when the Fed ceases rate hikes